Have you ever called an insurance company's call center to take care of business, but gave up after dialing the number several times to connect to a representative? For those who are wondering how to connect to the complicated customer center, we will provide you with the phone number (connection number) of the Prudential Life Insurance (KB Life) customer center representative.

Prudential Life Insurance Customer Center

The most common inquiries to insurance company customer centers, including Prudential Life Insurance, are about insurance claims, loan applications, and year-end tax settlement documents. We will explain the documents required for insurance claims and how to apply for a loan in the post below.

If you have difficulty connecting with a counselor by phone, you can resolve your inquiry through conversation with the AI chatbot below.

Have you ever signed up for insurance without your knowledge? A campaign to collect unrefunded insurance claims is being carried out through the integration of life insurance and non-life insurance. You can check all insurance policies signed up in your name at once through the post below.

If you are curious about unrefunded insurance premiums that you have not been able to find due to being busy and the cancellation refund amount of the insurance you are subscribed to, please check the information below and get more information.

삼성생명 보험미환급금 및 휴면보험 조회하고 신청하기

힘들게 보험료 납입금 끝냈지만 환급받지 않고 잊어버린 보험금 없으세요? 바쁘게 살다 보면 만기가 되었지만 찾지 않은 보험미환급금이나 휴면보험금이 생기기 마련입니다. 그래서 오늘은 삼

njobn.tistory.com

Prudential Life Insurance Claim Method

To claim Prudential Life insurance, you must submit a handwritten insurance claim and attach relevant documents according to the type of claim (death, disability, diagnosis, hospitalization, etc.).

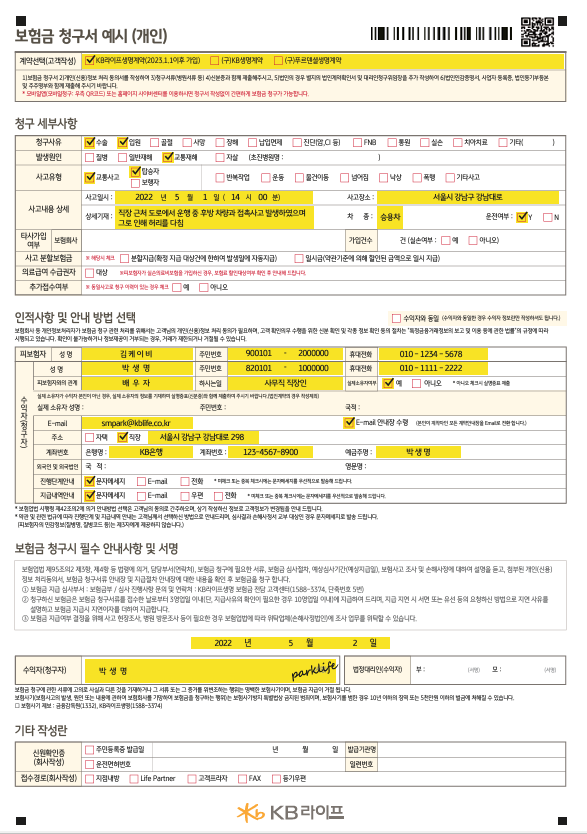

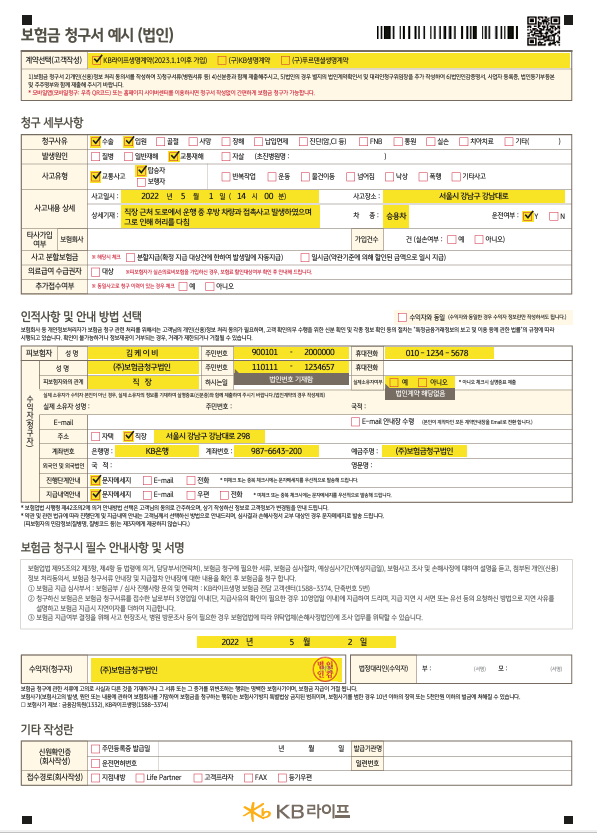

Insurance claims are divided into [insurance claim for individual beneficiaries], which is used when an individual is the beneficiary, and [insurance claim for corporate or group beneficiaries], which is used when a corporation or organization is designated as the beneficiary.

Generally, when an individual signs up for insurance, the beneficiary is designated as an individual, and when a company signs up for employee group insurance, the beneficiary is designated as a corporation or organization, or in some cases, as an individual.

Because insurance claims do not occur frequently, it can be difficult to write a claim. An example of writing a claim is attached below, so you can refer to it and complete it easily. Click on the attached image to enlarge it.

In addition to the insurance claim form, other required forms can be easily viewed and downloaded through the link below.

| division | Document name | |

| common | basic | Insurance claim form (company form) Personal (credit) information processing consent form (company form) Copy of ID (resident registration card, driver’s license, alien registration card, etc.) |

| addition | If the beneficiary is a minor | Basic certificate for minors Family relationship certificate for minors * However, if the claim amount is less than 2 million won, it can be omitted. * When signing the invoice, the signatures of two people with parental authority are required (however, if the billing amount is less than 2 million won, the signature of one person with parental authority is allowed) |

| When there are multiple beneficiaries | Representative beneficiary designation form (company form) Seal impression certificate (or personal signature confirmation) |

|

| If the beneficiary is a legal heir | Certificate of family relationship based on insured person * If the beneficiary is a minor, additionally submit the above basic certificate for minors and family relationship certificate. |

|

| If the beneficiary is a corporation | Corporate seal and corporate seal certificate Business Registration |

|

| If the beneficiary is a foreign national or foreign corporation | Copy of ID card (copy of passport, etc.) that can verify English (corporation) name and nationality | |

The documents that must be prepared vary depending on the reason for the insurance claim (death, disability, diagnosis, hospitalization, etc.). You can check the insurance claim form, documents required to be issued by the hospital, and additional documents through the link below.

Prudential Life Insurance Claim Payment Date

When filing a claim with an insurance company, investigation or verification may be required in some cases. If an investigation or additional confirmation is required, the insurance claim will be paid within 10 business days. If an investigation or confirmation process is not required, the claim will be paid within 3 business days.

Prudential Life Insurance Claim Deadline

As you lead a busy daily life, you may forget to file an insurance claim. The statute of limitations for an insurance claim is 3 years, so please file a claim within the deadline to receive compensation.